By Mason Schlensker

As of 2023, 43 million Americans are in debt with federal student loans. These student loans are the second largest source of consumer debt right behind mortgages. The average U.S student borrows $29,100 in order to attend their college of choice. If the average student is in this much debt while in school, how do these students manage their finances during their schooling years in order to survive? Some are receiving help from family and/or scholarships, but others are receiving no source of help. What are students at SVU doing to manage their finances? Has high inflation had negative impacts on students and forced them to make difficult financial decisions? We will jump into those questions in this article, so stay tuned!

Impact of Inflation on Students

In the U.S. many students struggle to be able to support themselves financially, and high inflation rates don’t make being a college student any easier. Inflation is when the purchasing power of money decreases. Since 2020, the consumer price inflation has risen by 19.6%. This means that for every dollar that you own, you have about 20 cents less of purchasing power to each of the dollars. Students who desperately need to save money in order to pay off student loans and be financially stable while attending college, are conflicted with this obstacle.

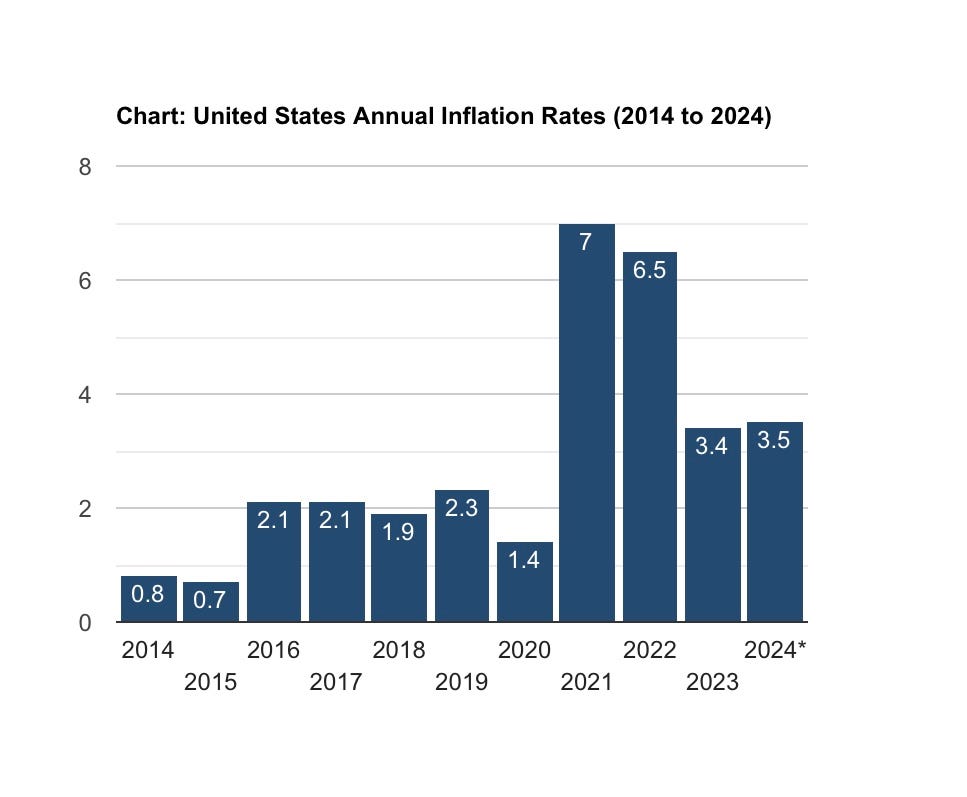

From this graph, we see the annual inflation rate in the United States from 2014–2024. From 2014–2020, the inflation rate never exceeded 2.3%. In 2021, inflation reached a high of 7%. These increasing prices of goods such as groceries, gas, and other consumer items have a large impact on individuals with low income. College students who are in debt are at a great disadvantage because working a full time job while in school seems almost impossible these days. Minimum wage jobs provide almost no financial stability.

According to a study done by BestColleges, two thirds of college students (66%) say that inflation impacts their financial situation. Also, three out of five students say that inflation doesn’t just affect their financial well-being, but also their mental well-being as well. Personally, I agree with the students that say inflation has an affect on their financial well-being. Whenever I go to the grocery store, I feel as though I do not have to buy very many items before the final price gets a little too high for my liking. Gas prices also tend to make me grimace every time I see that total price go up on the pump. I know that college students alone aren’t the only ones affected by the increase in the prices of goods and services, but being enrolled full time in school limits the amount of hours that are able to be worked in order to feel stable financially.

The overall national student loan debt, as shown above, has been on the incline for many years and has almost reached 2 trillion dollars. There was a decrease in 2023 that could potentially be the start to a slight decline in the overall debt. It will be interesting to see the statistics for this upcoming year on whether or not the national student loan debt total has gone up or down from the previous year.

This graph also shows that the overall student loan debt in the United States has more than tripled within the last decade. These poor students are taking on a large risk that may or may not benefit them in their future. I believe that students in high school should be more well educated about the financial risk of going to a college and getting a degree, especially if they have little to no financial help.

How SVU Students Survive Financially

When it comes to finances, SVU has a wide variety of students that come from different financial backgrounds which results in diverse ways that people pay for their schooling. After financial aid, the average yearly cost of SVU is $21,387 which makes a full four year education add up to over $85,000. At SVU, there are some students who pay for their own education, and there are others that receive help from scholarships and even family members. Studies show that 87% of families use some of their own income or savings in order to pay for their education. With that being said, the other 13% of students are put at a financial disadvantage.

Southern Virginia University is located in a small town called Buena Vista in the mountains of Virginia. In a small town, there is a very small selection of jobs for students. Many students make the decision to work for the school. These jobs include working in the cafeteria, library, mail center, grounds crew, and other positions that are available on campus. For some students, these jobs don’t have much appeal to them and they work elsewhere. The only problem is that in order to work off campus, a vehicle is almost always necessary. There are not many work options available for students that are within walking distance. Lexington is home to a lot more working opportunities, but it is about a ten minute drive.

Working only over the summer seems to be the solution for many students, however, it has its downsides. When living as a college student, money seems to just disappear sometimes. When I personally worked over the summer, I came back to school, and by the time the school year ended, I would find my bank account much lower than I would have liked it. Food, gas, and other expenses were enough to put my summer savings to the test. This method of earning money and depleting it in a short amount of time is not the wisest method, but for some students, it is the only way to get by while also being a student.

Balancing Time as a Student

Many students at SVU simply just don’t have the time to make enough during school in order to feel financially secure. Many need help from friends and family in order to support their daily needs. With a large percentage of SVU students being athletes, time is very limited due to practices, gym time, classes and homework.

I talked to Ethan Campbell, Senior, who has played both tennis and golf for SVU about how it is managing classes, sports and work here at the school. He said “I would say that the toughest thing about playing a sport, working and taking classes at the same time is balancing my workload and making sure that I get everything done even if it cuts into down time. With that comes a lot of late nights and make-up work and it takes a lot of discipline but it is worth it to be able to have the privilege to play a sport at the college level and be able to go to school and pursue a degree.”

Sacrifices are made daily when you are a student athlete. Many who do not play sports have the luxury of taking fun trips with friends, having time to relax, and the ability to feel like they have all the time in the world to get their homework done. Ethan mentioned how he sacrifices sleep and also needs to do make-up work in order to stay on top of his classes. Athletes find themselves missing multiple classes during the year due to games, competitions, and matches which ultimately force them to put in extra work to stay on top of their academics.

However, even with the sacrifices, Ethan describes the stress and time commitment as “worth it.” He also mentions how it is a privilege to play a collegiate sport. This ultimately shows that the stress is worth the competition for these athletes. Even without athletic scholarships in Division III sports, these athletes are dedicated to the sport without the incentive of having their schooling entirely paid for.

Personally, I have found that there is very little time for working and making money when you play a sport at SVU, especially with golf. The golf season is during the fall and the spring, so the time we spend on the golf course is very high throughout the year. With classes taking up the mornings, golf taking up the afternoon and evenings, homework must be done in the evenings leaving almost no time for a part-time job. Unless a part-time job works around the golf schedule (which many jobs do not), it is difficult for student athletes in season to find a job that can coordinate with their schedules.

United States Financial Literacy Problem

Even with DI athletes and their scholarships, financial stability is still in question. The sudden rise of NIL (Name, Image, and Likeness) deals has awarded these athletes large amounts of money. In an article called Why Student-Athletes May Face Financial Literacy Gap as Their Wealth-Building Chances Grow it says, “According to a 2022 Next Gen Personal Finance report, only eight states currently mandate financial literacy courses in their public high schools (though seven states are moving to implement a similar mandate in the coming future). In addition to the lack of financial literacy education, Next Gen also reported that only 22.7% of high school graduates had completed a standalone Personal Finance course.

This lack of financial literacy taught in schools is one of the reasons that so many students after college go into large amounts of debt. Students fail to analyze the risk they are taking when they are borrowing a large amount of money. A good start to improve the financial knowledge of young students is for high schools to provide finance and economic classes that are required and teach students the risks of obtaining debt and how to manage it.

This same article greatly describes the dangers of debt for these students as well. It says, “The difficulties of financial literacy are exacerbated even further when athletes arrive at a professional level and sign their contracts. Loans are often necessary for even high-profile incoming recruits to obtain a higher education, which can result in unexpected interest rates and unclear repayment timelines for those lacking financial literacy.

This isn’t just speculation — “ The U.S. News & World Report found that in a survey of roughly 30,000 college students, 37% were unable to afford the student loans they had taken on.”

As a major in Business Management, I have gained an understanding about smart financial decisions and managing debt through many different classes and courses that I have taken throughout my years as a student at SVU. With money management being an applicable topic for everyone, I am surprised that more students don’t decide to take a personal finance class. When you learn how to properly manage your finances, you can properly set your life up for success as you budget and invest for your future.

Financial Problems for College Students

There are so many ways in which college students struggle financially. According to ebsco.com, the most common financial problems that are shown to impact college students are: 1) Financial stress that causes lack of focus on academics 2) Food insecurity 3) Housing insecurity 4) Lack of understanding about credit 5) Credit card debt 6) Losing money on investments.

It is no surprise that personal finance struggles have a negative impact on grades and academic performance. As humans, our first priority is to have the necessities to survive. When those needs are limited and in question, a person’s focus is only on gaining back that necessity. For example, let’s say that a student has limited funds in order to pay this month’s rent for their apartment. This student is going to realize that their need for shelter is at risk. The student will then dedicate most of, if not all their time to find a way to pay that rent, putting aside all other priorities such as school and classes. Once that need is met, then focus is regained. When that need is not met, the focus taken away from those classes may prohibit the student from performing well in their particular classes.

Credit Card debt has also plagued students and put them into a financial hole that is difficult to escape. Almost 65% of college students have credit card debt according to a College Finance study. This study also states that the average credit card debt that these students currently have is $3,280 which is just shy of the average credit card limit of $3,568. This means that these students are using all the credit that is available to them. Again, this debt is most likely the result of a lack of understanding the potential risks of going into debt.

Conclusion

With inflation rising and student loans continuing to put college students in financial debt, the average college student is in a state of a financial crisis. This crisis is a factor of the lack of financial literacy of students here in the United States. Many college students are not educated in the risks that come from taking on student loan debt and also credit card debt. Taking on thousands of dollars of debt is a huge risk for many students who end up not finding a high paying job right after school. With this weight of debt resting upon their shoulders, stress is ultimately built up and affects the mental state of students. Specifically for SVU, many student athletes are faced with balancing classes, athletics, and work. With good flexible jobs being low in number around Buena Vista and Lexington, students are having to rely on family or their summer savings in order to have enough money to get through the school year.

In order to help college students and young adults know about the financial risks that are placed before them, there must be a way to teach students either in high school or some other method. If these students gain an understanding of how to manage debt, odds are, we will see a decline in the average student debt per person here in our country.

College Students and Financial Literacy: Do They Understand the Risks? was originally published in The Herald on Medium, where people are continuing the conversation by highlighting and responding to this story.